Blogger’s Note: The following is an abridged version of an article in the Business Section of today’s New York Times ...with my comments interspersed.

April 13, 2009

China Slows Purchases of U.S. and Other Bonds

By KEITH BRADSHER

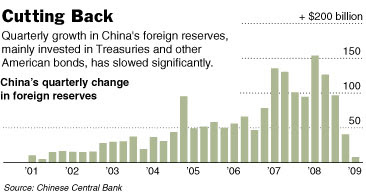

HONG KONG — Reversing its role as the world’s fastest-growing buyer of United States Treasuries and other foreign bonds, the Chinese government actually sold bonds heavily in January and February before resuming purchases in March, according to data released during the weekend by China’s central bank.

China’s foreign reserves grew in the first quarter of this year at the slowest pace in nearly eight years, edging up $7.7 billion, compared with a record increase of $153.9 billion in the same quarter last year.

China has lent vast sums to the United States — roughly two-thirds of the central bank’s $1.95 trillion in foreign reserves are believed to be in American securities. But the Chinese government now finances a dwindling percentage of new American mortgages and government borrowing.

This means China’s central bank currently owns about $1.3 trillion in American securities, which is a large investment to them but only about 17% of the current U.S. national debt (see below).

The main effect of slower bond purchases may be a weakening of Beijing’s influence in Washington as the Treasury becomes less reliant on purchases by the Chinese central bank.

Uhh... Less reliant? With the national debt practically doubling in the Bush years from $5.7 trillion to $10.0 trillion – and as of 7 April is standing at $11.2 trillion – one has to ask: Just who is going to step in and buy our ever mounting debt if the Chinese stop buying ...or worse, if they start selling? Answer: No one but suckers.

Asked about the balance of financial power between China and the United States, one of the Chinese government’s top monetary economists, Yu Yongding, replied that “I think it’s mainly in favor of the United States.”

He cited a saying attributed to John Maynard Keynes: “If you owe your bank manager a thousand pounds, you are at his mercy. If you owe him a million pounds, he is at your mercy.”

But if you are known to have squandered that million pounds and then gambled away couple million more on top of that, your bank manager realizes he is no longer at your mercy. In fact he is left with no choice but to write off his loan to you ...and turn his thoughts to the most merciless punishment he can legally lay on you!

Private investors from around the world, including the United States, have been buying more American bonds in search of a refuge from global financial troubles. This has made the Chinese government’s cash less necessary and kept interest rates low in the United States over the winter despite the Chinese pullback.

Uhh... How many savvy investors truly believe American bonds are “a refuge from global financial troubles”? The only way I can think of that the Chinese government’s cash has been made “less necessary” would be if the Fed is buying this stupendous debt with taxpayer money.

There have also been some signs that Americans may consume less and save more money in response to hard economic times. This would further decrease the American dependence on Chinese savings.

Just “some signs”? The U.S. unemployment rate has been rising exponentially for two full years. Of course, Americans must consume less now and try to save more. But the more Americans who lose their jobs, the fewer there will be who have anything to save. And the bloated ranks of job seekers will depress the wages of those still working. So it is totally dopy to think that Americans’ savings can even slightly compensate for the Chinese government pulling out of their “T-bill” investments.

Mr. Wen voiced concern on March 13 about China’s dependence on the United States: “We have lent a huge amount of money to the U.S. Of course we are concerned about the safety of our assets. To be honest, I am definitely a little worried.”

The main worry of Chinese officials has been that American efforts to fight the current economic downturn will result in inflation and erode the value of American bonds, Chinese economists said in interviews in Beijing on Thursday and Friday.

“They are quite nervous about the purchasing power of fixed-income assets,” said Yu Qiao, an economics professor at Tsinghua University.

The Chinese Premier and other officials are talking about what the mainstream media repeatedly refer to as “ultra safe” U.S. Treasury bonds. Why are we being told they are “ultra safe” when the Chinese Premier is “definitely a little worried” about them? Answer: if a single country (e.g., Korea or Brazil) should ever start seriously selling, then so must China and Japan and everyone else. It would be a panic that would swiftly drive down the dollar values of all classes T-bills, pushing the interest rates the other way, that is, skyward. And in that instant most of those invested in U.S. T-bills and/or any other interest-paying U.S. bonds will loose their shirts.

The abrupt slowdown in China’s accumulation of foreign reserves ... seems to suggest that investors were sending large sums of money out of mainland China early this year in response to worries about the country’s economic future and possibly its social stability in the face of rising unemployment.

My thought: When Americans finally understand that their unemployment rate has reached about 20% when calculated by more realistic methods, possibly there will be social instability in the U.S. too.

Evidence of such capital flight included a flood of cash into the Hong Kong dollar. Mainland tourists were even buying gold and diamonds during Chinese new year holidays here in late January.

Well, the gold and diamonds are excellent hedges against currency devaluations...

China’s reserves have soared in recent years as the People’s Bank bought dollars on a huge scale to prevent China’s currency from appreciating as money poured into the country from trade surpluses and heavy foreign investment. But China’s trade surpluses have narrowed slightly as exports have fallen, while foreign investment has slowed as multinationals have conserved their cash.

Heavy purchases of Hong Kong dollars by mainland Chinese residents early this year also have the indirect effect of helping the United States borrow money. The Hong Kong government pegs its currency to the American dollar, and stepped up its purchases of Treasury bonds this winter in response to strong demand for Hong Kong dollars.

Well, I don’t know to what extent Hong Kong has really been buying Treasury bonds. But I do have a hutch as to why mainland Chinese have been converting their greenbacks to Hong Kong dollars: When the American dollar ultimately crashes, you can count on Hong Kong to UNpeg their dollar from the freefalling greenback...

No comments:

Post a Comment